What Is Arbitrage?

How does it work Flashloans and Smart Contract?

What Is Arbitrage in Crypto Trading?

What Is Arbitrage?

Arbitrage is a trading strategy that involves taking advantage of price differences for the same or similar financial instruments across different markets or platforms.

Traders exploit these inefficiencies to generate risk-free profits by buying the asset in the lower-priced market and simultaneously selling it in the higher-priced one.

This concept is based on the principle of ‘law of one price’, which suggests that identical goods should sell for the same price in efficient markets.

However, due to factors like market inefficiencies, transaction costs, or timing differences, price discrepancies may arise. Arbitrage trading helps align

prices across markets, contributing to their overall efficiency.

There are several types of arbitrage, including:

Spatial Arbitrage:

Taking advantage of price differences in different geographic locations or exchanges.

Triangular Arbitrage:

Occurs in currency trading by leveraging exchange rate disparities between three currencies.

Statistical Arbitrage:

Using advanced algorithms to identify patterns and temporary pricing inefficiencies.

While arbitrage is often considered low risk, it requires sufficient capital plus hardware and software that support fast execution, as opportunities are often fleeting due to high competition.

Additionally, transaction fees and regulatory constraints can impact profitability. Arbitrage remains a cornerstone strategy for advanced and professional traders, particularly in financial markets like stocks, foreign exchange, and cryptocurrencies.

What are the main features of SmartBot ?

The system function analyzes factors such as trading volume, price volatility, social media, liquidity, and market trends to provide comprehensive insights into the identified pairs.

Listing Sniper:

Once a liquidity adding transaction is detected, the function analyzes the transaction details to determine if it meets the desired criteria. For example, it might consider factors

such as the token pair, liquidity amount, and deployer balance. Then it will proceed to buy the desired token before everyone else.

Token Elite Checker:

SmartBot gain access to comprehensive token information, including market performance, honeypot checking, trading volume liquidity, and historical data. Our system's

advanced metrics and indicators assess token health and potential, incorporating factors like market capitalization, community engagement, and development activity.

Mirror Frontrun Sniper:

Copies the actions of specialized wallets. It is designed to replicate the trades and actions performed by specific targeted wallets. Monitors the targeted wallet's transactions

in real-time and automatically executes identical trades or actions in the user's own wallet and front-running them.

Pre-Sale Sniper:

Once a presale is detected , the function analyzes the details of the presale event and executes a purchase ahead of others. This analysis encompasses information such as the

token being offered, the token price, allocation limits, presale duration, and any specific rules or requirements.

Swap Limit Orders:

SmartBot customize trading preferences by setting the desired token pair, target price, and order expiration time. The system function constantly monitors the market,

tracking price movements and executing the swap when the specified price conditions are met.

Trading Bot Strategies:

SmartBot access a wide range of pre-built trading strategies for DEX designed to maximize returns and minimize risks. The system function continuously monitors

market conditions, evaluates historical data, and adapts strategies in real-time to capitalize on emerging opportunities and mitigate potential losses.

Defining Aave

What is Aave?

https://docs.aave.com/faq/

Built on the Ethereum blockchain, Aave is a set of programmable smart contracts that provides both humans and other smart contracts access to a permissionless source of on-chain liquidity.

Like any good money market, Aave connects lenders who want to earn a passive income with borrowers who need to borrow working capital.

Importantly, the enforcement of the market’s rules is not performed by a centralized entity, but instead, programmatic code which is governed by a decentralized

community with financial skin in the game (AAVE token holders).

( Aave is a liquidity provider for the Ethereum ecosystem. We enable humans and smart contracts to borrow and lend money, without the need for a centralized authority.

Aave is a set of programmable smart contracts that provides both humans and other smart contracts access to a permissionless source of on-chain liquidity.

Aave is a decentralized money market that allows lenders and borrowers to interact directly with each other.

Lenders can earn a passive income by lending their AAVE tokens to borrowers.

Borrowers can get access to working capital by borrowing AAVE tokens from lenders. )

What is Flashloan?

What is a Flash Loan?

https://docs.aave.com/faq/flash-loans#what-is-a-flash-loan

Flash Loans are the first uncollateralized loan option in DeFi! Designed for developers, Flash Loans enable you to borrow instantly and easily, no collateral

needed provided that the liquidity is returned to the pool within one transaction block.

If this does not happen, the whole transaction is reversed to effectively undo the actions executed until that point. This guarantees the safety of the funds in the reserve pool.

Use-cases include arbitrage, collateral swapping, self-liquidation, and many more.

Flash Loans are introduced by the Aave, an open-source lending protocol for anyone to deposit and borrow cryptographic assets.

Essentially, flashloans let users borrow any amount up to the total liquidity available without any collateral, so long as the loan is repaid in the same transaction.

If the loan is not repaid, the whole transaction will be reverted. With flashloan anyone can access a massive amount of liquidity and use the loan with other protocols however they want.

You can become a ‘whale’ without any capital.

Flash loans have a 0.09% fee on the interest-generating protocol Aave. It requires a minimum of three operations:

1) borrow on Aave,

2) swap on a decentralized exchange, and

3) arbitrage swap on another decentralized exchange to realize profit. Flash loans must be paid back in the same asset you borrowed. If you borrow Dai, you need to pay your loan back in Dai.

How do flash loans work?

How do flash loans work?

docs.aave.com

Flash Loans are an advanced concept aimed at developers. You must have a good understanding of EVM, programming,

and smart contracts to be able to use this feature.

To better understand flash loans, one must understand the Ethereum blockchain, smart contracts, and the lending process.

Flash Loans are special transactions that allow the borrowing of an asset, as long as the borrowed amount (and a fee) is returned before the end of the transaction

(also called One Block Borrows). These transactions do not require a user to supply collateral prior to engaging in the transaction.

There is no real world analogy to Flash Loans, so it requires some basic understanding of how state is managed within blocks in blockchains.

Transactions on the Ethereum blockchain are conducted through peer-to-peer smart contracts. When one party/person wishes to conduct a transaction using a smart contract,

the Ethereum network will use several smart contract “functions” to execute the transaction as quickly as possible.

Smart contracts are what allows flash loans to be executed. Through smart contract-based lending protocols, flash loans allow a borrower to receive ETH tokens and uphold

the condition that the tokens must be repaid to the lender. You can borrow ETH or any supported ERC20 token through a flash loan.

While it’s previously stated that flash loans can be obtained without collateral, well…they need to be repaid within the next blockchain transaction, roughly 15 seconds.

That’s the catch.

If either party does not uphold their side of the agreement, such as the borrower not having collateral to repay, the transaction fails, is rolled back, and the borrower only pays the gas fee.

Smart Contract

Smart Contract can take a loan out for one token and trade it on another platform with the asset listed for a higher price.

Smart Contract can also use flash loans to refinance loans on other lending protocols or swap collateral.

There is a 0.3% fee for this service. Notably, this protocol became one of the core components of most yield farming systems in use today.

Crypto Arbitrage Bot

The crypto arbitrage bot is just one of many options available to investors to help maximize their performance. Cryptocurrency arbitrage bots operate on a specific set of rules.

Ones that, by design, carry out automated trades with no need for interference from human users. All in all, they are a handy, not to mention powerful, tool in round-the-clock trading.

Traders have the ability to create strategies with the power to achieve profits consistently. With this, they can free themselves from the pain of directing a platform to perform

identical processes over and over. However, a cryptocurrency arbitrage bot is different in that it makes hundreds or thousands of intricate decisions. And it can do so in the same

timespan that the average human makes about one or two.

What strategies does CRYPTO BOT use?

https://crypto-bot.eu/en/faqThis type of trading is purely algorithm-based. What this means is that there are zero emotional issues present that could potentially disrupt it. All the bots do is execute their pre-set strategies as per requirement and they continuously do so.

Arbitrage trades

How Does Arbitrage Work?

The most popular use case by far is Arbitrage trades. For those unfamiliar, arbitrage is the strategy of making a profit from price differences between different markets.

To make a significant amount of profit, you will need substantial capital to get started.

And this, is where the magic happens.

— We use flashloan to generate free money with no upfront cost.

Arbitrage trading, independent of flash loans or blockchain, is when you have the same asset with two different prices in two different exchanges.

For example, let’s look at two exchanges: Uniswap and Sushiswap. Sushiswap is a fork of Uniswap, which means they run on the same contract code.

While they’re two different exchanges, we can use the same code to execute the same trade. Also, since Sushiswap is a newer exchange, there may be fewer bots written for it.

Arbitrage works like this: One ether is worth 80 Dai on Uniswap and 100 Dai on Sushiswap. We purchase 1 ETH on Uniswap and then immediately sell it on Sushiswap,

for a profit of 20 Dai (minus gas and fees). This is a typical, profitable arbitrage trade.

* If flash loans are "no risk", why doesn't everyone do them?

- Because you have to have a smart developers who must route the flash loan and enough ETH to cover the gas costs which can be in the hundreds of $$ when the tx goes through.

- Flash loans can be risky and should only be used by experienced developers and traders who understand the potential risks involved.

- Gas fees yes but also if you use flashloan for arbitrage you can get slippage on dex and the flashloan will cost more than profit.

* Why don't you run bots yourself but sell services?

- In fact, we run and manage the bot and smart contract ourselves only that you pay the fees on the exchanges.

In return you get the reward from trading and our developers receive an award for their scientific work in bot and smart contract upgrade.

New Europe crypto trading law for cryptocurrency trading is considered your primary activity (as a profession), the profits may be taxed as trading income (Income Tax), which is subject to higher rates (40%, 45%).

It is more profitable for us to be just developers and take a percentage of the profits. The huge taxes and fees for profit and running a company and office in Europe exceed the planned profits for all our developers.

We also collect very important data on cryptocurrency trading, which we provide to scientific companies and receive donations.

- Our main goal is to collect a large amount of data from hundreds of bots on different stock exchanges at different times and get the reward from the scientific research funds .

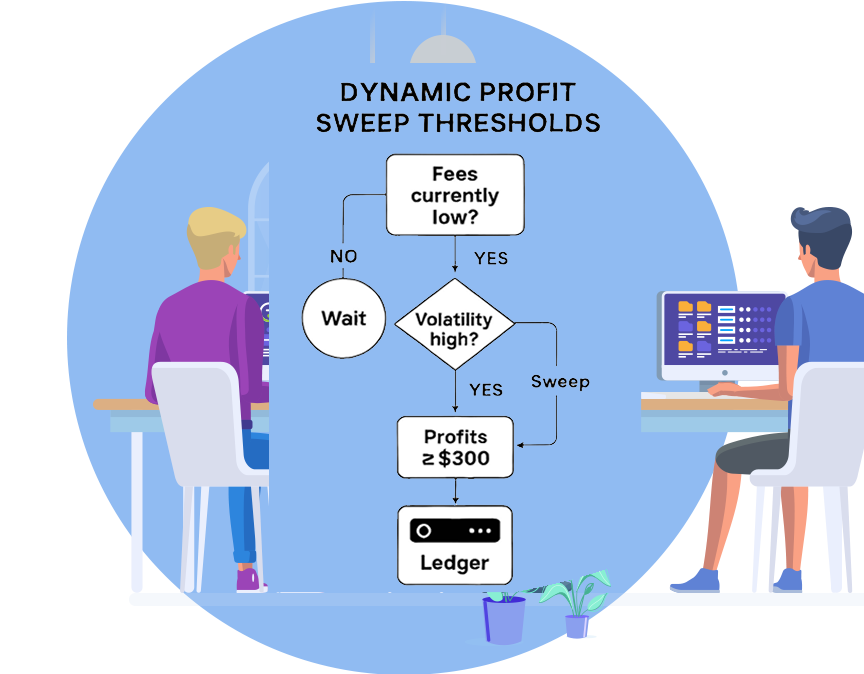

* Why should I buy Ledger if I have my own?

You can buy our ledger or you can use your own ledger.

The advantage of our ledger is that it is connected to all the dex accounts needed for crypto trading and arbitrage

for sign fee requests with your keys in a ledger.

You will only need to set your own password and another 12-phrase.

You can also use your ledger, but you will need to connect a dozen accounts to your crypto address in the ledger to receive your earnings.

To make trading and arbitrage possible, the addresses from the purchased Ledger will be linked to our accounts on decentralized exchanges (DEX), THORChain protocols and liquidity pools, for the bot and smart contract to work successfully.

This will ensure that developers are working with the correct device and only you will know your seed and password for receiving earnings.

(Hot Wallet 🔥 Your purchased plan)

The minimum $250 plan is used for hot wallet.

You will see information about Hot Wallet every 6-12 hours in your dashboard on our website.

(Holds only the small amount of crypto you need for rapid trades.

-Connected directly to your exchange account for instant API execution. -This is your "working capital").

Why this is important:

Security:

Your private keys are kept securely on the hardware wallet, and every transaction is signed directly on the device, preventing any intermediary from accessing or controlling your funds.

Autonomy:

This method allows for direct peer-to-peer transactions through the DEX's liquidity pools, maintaining your control over your assets and minimizing reliance on centralized entities.

Transparency:

The transaction is broadcast to the network, which is transparent and decentralized, ensuring no single entity can alter it.

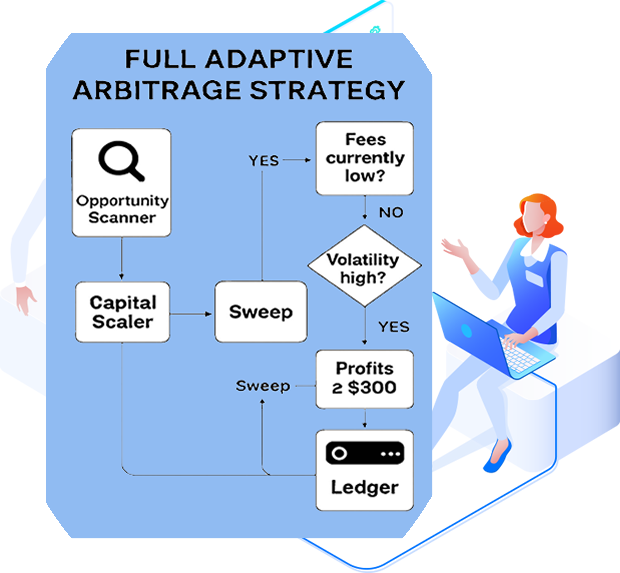

* What is my role as a ledger owner?

🚀 To Speed Up Arbitrage with Ledger Involved

Developer Use a Smart Contract with Pre-Approved Logic that executes arbitrage logic automatically.

The Ledger holder signs a transaction once to authorize the bot to interact with the contract.

The bot then triggers the contract without needing further signatures—speeding up execution.