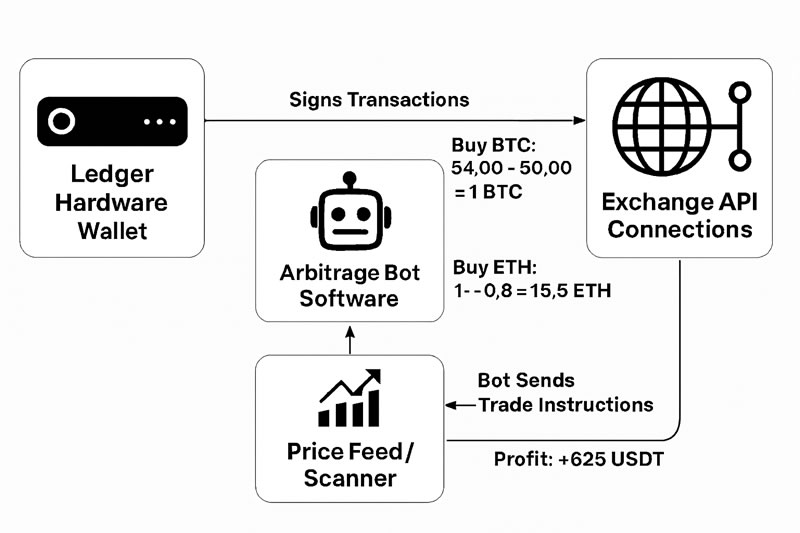

Legitimate arbitrage bot setup could work with a Ledger hardware wallet in the loop, so you get the speed of automation without sacrificing the security of your private keys.

Ledger is just a bridge between those protocols and smart contracts and our DEX accounts.

* Ledger Hardware Wallet → Stores your private keys offline and signs transactions securely.

* Arbitrage Bot Software → Runs on your computer or a VPS, scanning exchanges for price gaps and executing trades.

* Exchange API Connections → Secure keys from exchanges (Binance, Kraken, KuCoin, etc.) that allow the bot to place orders.

* Price Feed / Scanner → Built-in or external service to detect profitable opportunities in real time.

1.Bot Scans for Opportunities

- Constantly checks multiple exchanges or trading pairs for profitable spreads (spatial or triangular arbitrage).

2.Bot Sends Trade Instructions

- When it finds a gap, it prepares the buy/sell orders.

3.Ledger Signs Transactions

-Instead of the bot holding your private keys, it sends the transaction to your Ledger for approval/signing.

-You confirm on the Ledger’s physical buttons — preventing unauthorized trades.

4.Execution on Exchange

The signed transaction is sent to the exchange via API and executed instantly.

5.Funds Returned to Ledger

After the trade cycle, profits are withdrawn back to your Ledger wallet for cold storage.

- Keys Never Leave Ledger

→ Even if your bot server is hacked, the attacker can’t drain your wallet.

- Manual or Semi-Automated Approval

→ You can set the bot to require Ledger confirmation for each trade, or batch-confirm trusted trades.

Reduced Exchange Exposure

→ Profits are quickly moved off exchanges.

- Ledger Nano X connected via USB/Bluetooth.

- Custom Python Arbitrage Bot running on a VPS.

- APIs for Binance + Kraken.

- Workflow: Bot detects ETH price gap

→ Sends buy/sell orders

→ Ledger signs → Orders execute

→ Profits sent back to Ledger.

🧩 How to Read the Diagram

Price Feed / Scanner

→ Detects the USDT → BTC → ETH → USDT loop with the given prices.

Arbitrage Bot Software

→ Calculates the exact trade amounts and expected profit (+625 USDT before fees).

Ledger Hardware Wallet

→ Signs the transaction instructions securely so your keys never leave the device.

Exchange API Connections

→ Executes the three trades in sequence on the exchange.

Profit Withdrawal

→ Sends the resulting 50,625 USDT back to your Ledger for cold storage.

Market Snapshot (on a single exchange at the same moment):

BTC/USDT = 50,000 USDT per BTC

ETH/BTC = 0.08 BTC per ETH

ETH/USDT = 4,050 USDT per ETH

Step-by-Step Through the Flowchart

1. Price Feed / Scanner

Your bot detects a mismatch:

- Buying BTC with USDT, then ETH with BTC, then selling ETH for USDT yields a profit.

This is flagged instantly.

2. Arbitrage Bot Software

Calculates the loop:

-Start: 50,000 USDT

-Buy BTC: 50,000 ÷ 50,000 = 1 BTC

-Buy ETH: 1 BTC ÷ 0.08 = 12.5 ETH

-Sell ETH: 12.5 × 4,050 = 50,625 USDT

-Profit before fees: +625 USDT.

3. Ledger Hardware Wallet

Bot sends the trade instructions to your Ledger for signing.

You confirm on the device — your private keys never leave the Ledger.

4. Exchange API Connections

Signed orders are sent to the exchange via API.

Trades execute in milliseconds.

5.Profit Withdrawal

Bot automatically withdraws the 50,625 USDT back to your Ledger wallet.

Funds are now offline and secure.

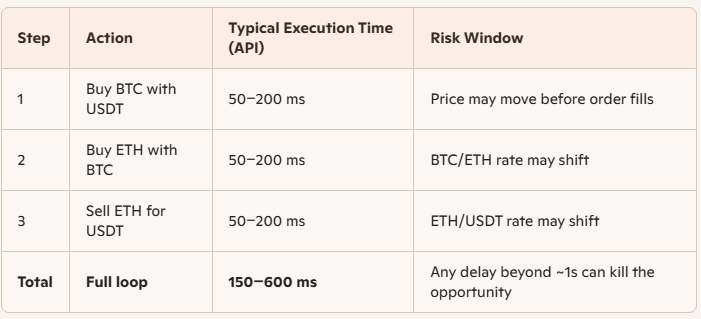

Why This Works Well With Ledger

Security:

-Even if your bot server is compromised, the attacker can’t move funds without your Ledger confirmation.

Speed:

-The bot handles detection and order placement instantly; Ledger adds a secure approval layer.

No Transfer Delays:

-Because all trades happen on one exchange, you avoid blockchain transfer times.

Ledger factor:

If you require manual confirmation on the Ledger for each leg, you’ll add seconds — too slow for most opportunities.

That’s why many traders keep a small “hot” balance on the exchange for instant execution, then sweep profits to Ledger after.

Using our earlier example

(profit before fees = +625 USDT):

📏 Profit Threshold Formula

A quick way to check if a loop is worth it:

Net Profit

=

(

End Amount

−

Start Amount

)

−

Total Fees

If Net Profit ≤ 0, we skip the trade.

⚠️ Key Takeaways

Speed is king — sub‑second execution is ideal.

Fees eat margins — even a 0.1% fee per leg can wipe out small gaps.

Ledger integration is best for securing profits after the loop, not for signing each leg in real time unless you accept slower trades.

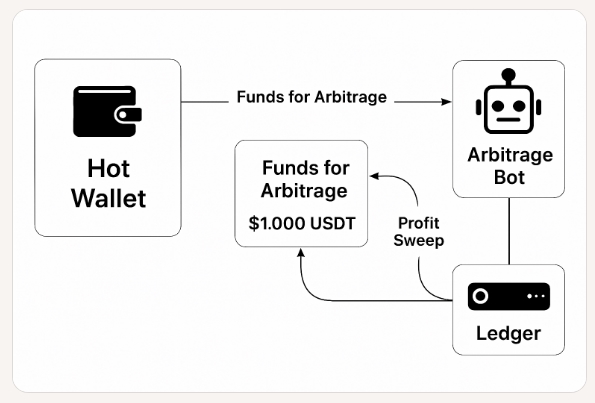

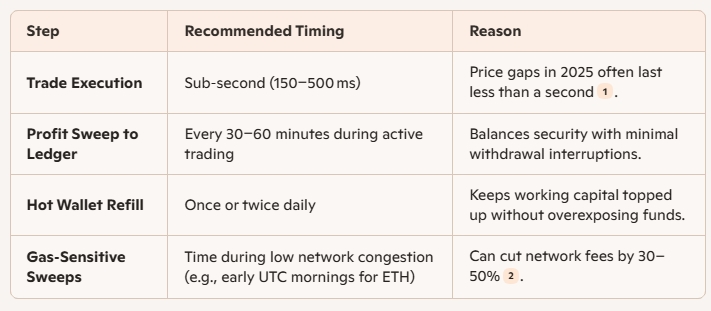

Hot Wallet 💨

Holds only the small amount of crypto you need for rapid trades.

-Connected directly to your exchange account for instant API execution.

-This is your “working capital” — e.g., $1,000 USDT in the example.

Arbitrage Bot 🤖

-Constantly scans prices via the Price Feed/Scanner.

-Executes trades in milliseconds using the hot wallet balance.

-Completes loops like USDT → BTC → ETH → USDT without blockchain transfer delays.

Profit Sweep 💱

-At set intervals (e.g., hourly or daily), the bot automatically withdraws profits from the hot wallet to your Ledger hardware wallet.

-This keeps your gains offline and safe from exchange hacks.

Ledger Hardware Wallet 🔐

-Cold storage for long-term holdings and profits.

-Private keys never touch the internet.

-Can be reloaded into the hot wallet when you want to scale up trading capital.

⚖️ Why This Hybrid Setup Works

Speed:

-The hot wallet ensures trades execute instantly without waiting for Ledger confirmations mid-loop.

Security:

-The Ledger ensures that only a small, controlled amount is ever exposed to exchange risk.

Scalability:

-You can adjust the hot wallet size based on market volatility and opportunity frequency.

Goal:

Execute trades fast enough to capture the spread, but sweep profits often enough to limit exchange risk.

Key Principle:

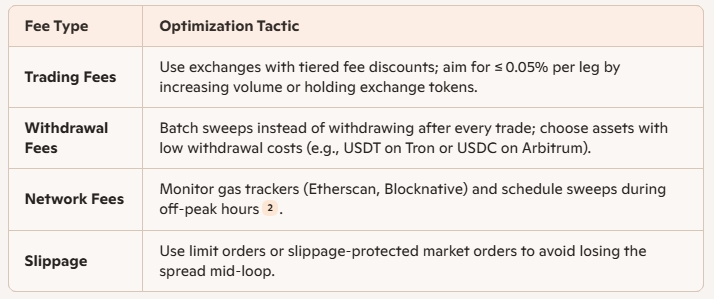

Your profit per loop must exceed total fees (trading + withdrawal + network) by a healthy margin.

Before executing, your bot should check:

Net Profit

=

(

End Amount

−

Start Amount

)

−

(

Trading Fees

+

Withdrawal Fees

+

Network Fees

)

-Keep Hot Wallet Small:

Just enough for 1–3 loops at your average trade size.

Automate Sweeps:

-Let the bot trigger Ledger withdrawals at set profit thresholds.

Diversify Pairs:

-More pairs = more opportunities, but also more API calls — balance speed and coverage.

Test in Sandbox Mode:

-Run the bot in paper‑trading mode to fine‑tune timing and fee parameters before risking real funds.

profit‑triggered sweep logic diagram

Hot Wallet 💼

Holds only your active trading capital (e.g., $1,000 USDT).

Connected to the exchange for instant execution.

Arbitrage Bot 🤖

Monitors live market prices and executes profitable loops in milliseconds.

After each loop, it updates your current profit tally.

Calculate Net Profit 📊

Bot subtracts all trading fees, withdrawal fees, and estimated network costs from gross profit.

This ensures you’re working with real net numbers, not just paper gains.

Profit Threshold Check 🎯

Compares net profit to your pre‑set target (e.g., $200 or 2% of hot wallet balance).

Threshold can be time‑based (sweep every hour) or profit‑based (sweep when target hit).

Sweep Trigger 🔄

If the threshold is met or exceeded, the bot initiates a withdrawal from the hot wallet to your Ledger.

If not, funds remain in the hot wallet for continued trading.

Ledger Hardware Wallet 🔐

Receives the swept profits into cold storage.

Private keys never leave the device, keeping gains safe from exchange or bot compromise.

Hands‑Off Security:

You don’t have to manually move profits — the bot does it automatically when it’s worth it.

Fee Efficiency:

Sweeps happen only when the profit justifies the network and withdrawal costs.

Risk Control:

Limits the amount exposed on the exchange at any given time.

Before setting thresholds, you need three key numbers:

Average Profit per Loop – e.g., 0.4% of trade size.

Average Fees per Sweep – trading + withdrawal + network.

Risk Tolerance – how much you’re comfortable leaving on the exchange.

A simple rule of thumb:

Sweep Threshold

=

Sweep Fees

×

Safety Factor

Average Profit per Loop

Safety Factor:

2–3× your sweep fees ensures each sweep is clearly worth it.

Example:

Sweep Fees = $15

Avg Profit per Loop = $5

Safety Factor = 3

Threshold =

(

15

×

3

)

÷

5

=

9

loops before sweeping.

Profit‑Based Sweep:

-Trigger when net profit ≥ threshold (e.g., $200).

Time‑Based Sweep:

-Trigger every X hours regardless of profit — useful in volatile markets to reduce exposure.

Hybrid:

-Sweep when either condition is met — the most common pro setup.

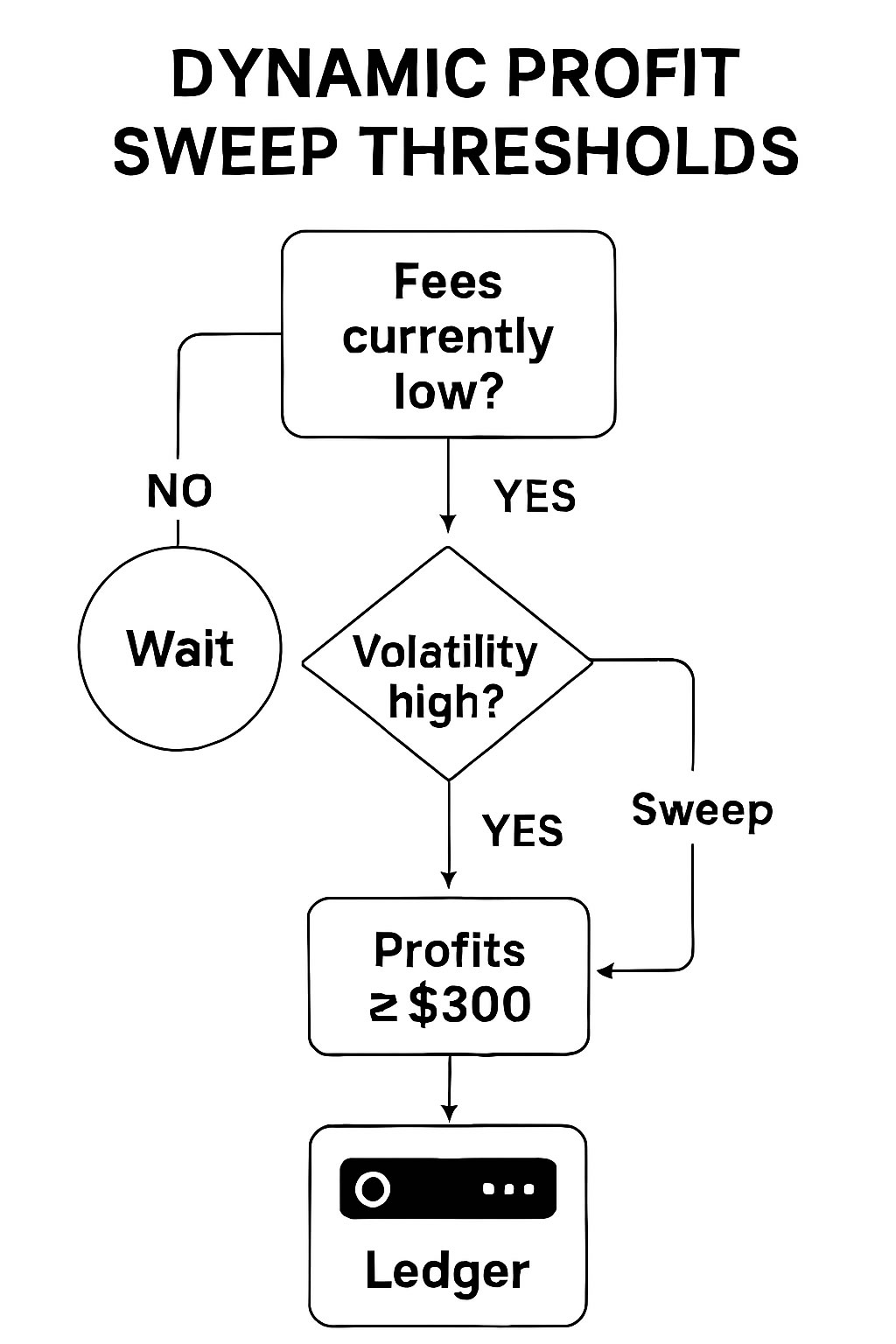

Dynamic Thresholds:

-Let your bot adjust thresholds based on live volatility and fee changes.

Fee‑Aware Sweeps:

-Skip sweeps when network fees spike (e.g., ETH gas surge).

Capital Cycling:

-Keep just enough in the hot wallet for 2–3 loops; sweep the rest.

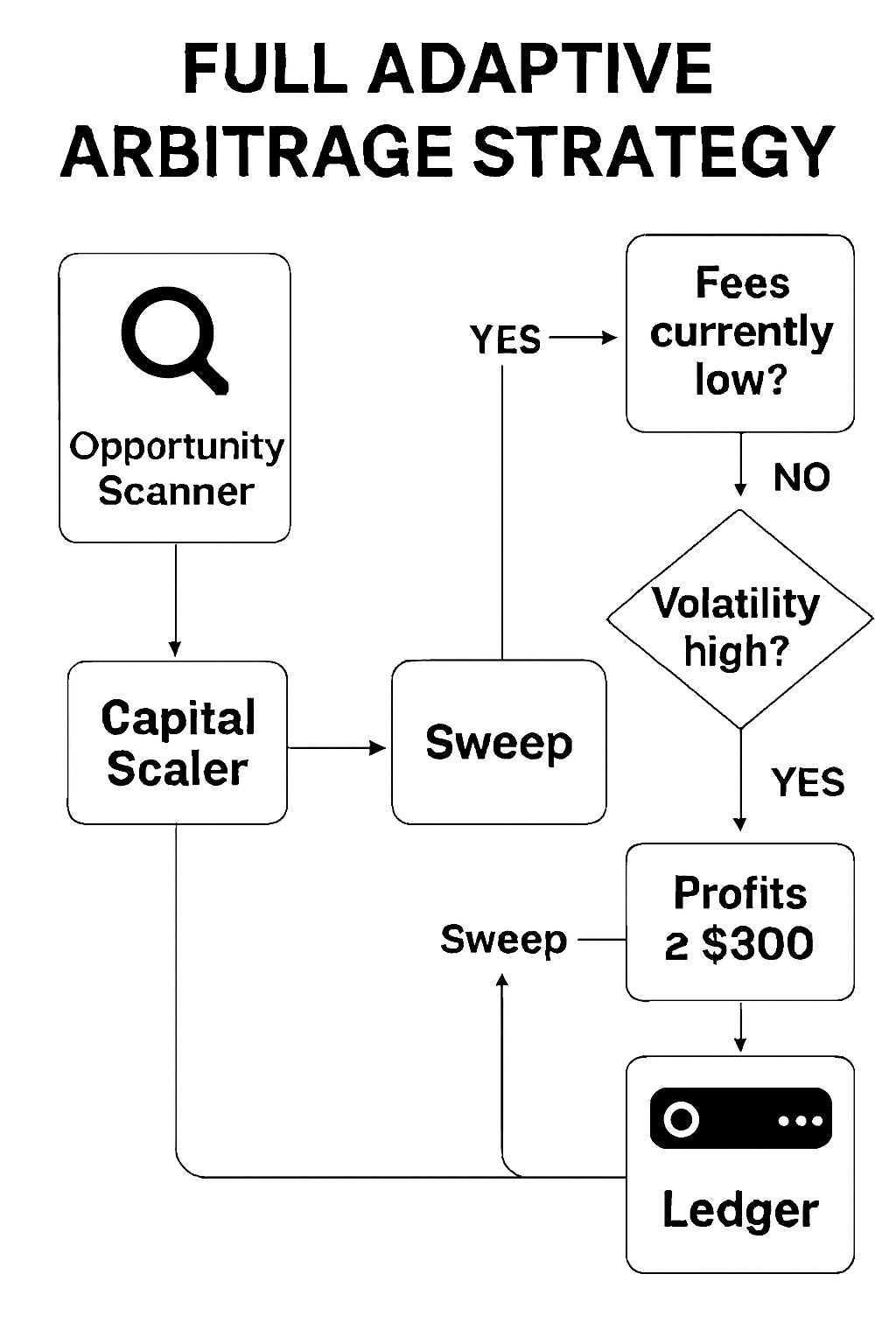

Fee Tracker 💸

Constantly monitors withdrawal and network fees.

If fees are high (e.g., ETH gas spike), the bot pauses sweeps to avoid wasting profit.

Market Monitor 📈

Checks volatility levels.

In high‑volatility conditions, the bot sweeps more aggressively to reduce exchange exposure.

Profit Calculator 📊

Calculates net profit per loop after all fees.

Compares this to your profit threshold (e.g., $300).

Decision Logic 🔄

If fees low + volatility high → Sweep immediately.

If fees low + volatility low → Sweep only if profit ≥ threshold.

If fees high → Wait until fees drop, unless volatility is extreme and risk outweighs cost.

Execution 🚀

When conditions are met, bot triggers a Profit Sweep from the hot wallet to your Ledger.

Ledger signs the transaction, keeping your keys offline.

1. Opportunity Scanner 🔍

Tracks how often profitable arbitrage loops appear.

If opportunities are frequent, the bot can justify holding more in the hot wallet for rapid-fire trades.

If they’re rare, it scales down to reduce exposure.

2. Volatility Tracker 📈

Measures market turbulence.

High volatility = more potential profit but also more risk → bot may keep capital lower and sweep more often.

Low volatility = safer environment → bot can keep more capital deployed.

3. Profit Analyzer 💰

Calculates average profit per loop and compares it to your target ROI.

If profit per loop is high, the bot can scale up hot wallet size to maximize gains.

3. Capital Scaler Logic ⚙️

Combines data from the scanner, volatility tracker, and profit analyzer.

Adjusts hot wallet size dynamically — e.g., from $1,000 to $3,000 — without manual intervention.

4. Integration with Profit Sweep Logic 🔄

Works hand-in-hand with your dynamic sweep thresholds.

Ensures that both amount at risk and sweep timing are optimized together.

5. Ledger Cold Storage 🔐

Any capital above the scaled hot wallet limit is automatically swept to your Ledger.

Keeps excess funds offline and safe.

This means your bot is now self‑balancing:

In a hot market with lots of opportunities, it trades with more ammo.

In a slow or risky market, it pulls back and locks funds away.

Calm Market

→ Bot keeps more capital in play, sweeps less often, focuses on efficiency.

Choppy Market

→ Bot reduces hot wallet size, sweeps more frequently, prioritizes security.

Fee Spikes

→ Bot delays sweeps until fees drop, unless volatility is extreme and risk outweighs cost.

Opportunity Surge

→ Bot scales up hot wallet size automatically to capture more trades.

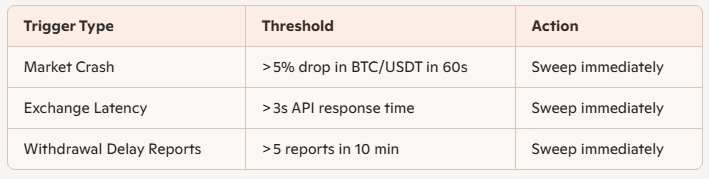

1. Risk Signal Detector

Market Crash Trigger:

Price drop > X% in Y seconds on any core trading pair.

Sudden liquidity drain (order book depth collapses).

Exchange Health Trigger:

-API downtime or abnormal latency.

-Withdrawal delays reported by other traders.

-Unusual spread widening across pairs.

2. Immediate Actions

Pause All New Trades

— Bot stops scanning and executing loops instantly.

Cancel Open Orders

— Prevents partial fills or stuck trades.

Full Withdrawal Command

— Bot sends all hot wallet funds to your Ledger wallet address.

Ledger Confirmation

— You approve the sweep on‑device (or pre‑authorize emergency sweeps for instant execution).

3. Safety Enhancements

-Pre‑Whitelisted Ledger Address:

-Set in exchange withdrawal settings so funds can only go to your Ledger.

Multi‑Signal Confirmation:

-Require at least two independent triggers (e.g., market crash + API errors) before activating.

Dry‑Run Testing:

-Simulate emergency sweeps to ensure speed and reliability.

1.Opportunity Scanner 🔍

Monitors multiple exchanges/pairs for profitable loops.

Feeds live data to the Arbitrage Bot.

2. Arbitrage Bot Core 🤖

Calculates potential profit per loop.

Checks against dynamic sweep logic and capital scaling rules before executing.

3. Hot Wallet 💼

Holds only the active trading capital (scaled dynamically).

Connected to exchange APIs for instant execution.

4. Capital Scaling Module 📊

Increases hot wallet size when opportunities are frequent and safe.

Reduces size when markets are slow or risky.

Sends excess funds to Ledger.

5. Dynamic Profit Sweep Logic 💱

Monitors net profit after fees.

Sweeps to Ledger when profit ≥ threshold or time‑based backup triggers.

Fee‑aware: delays sweeps if network/withdrawal fees are high.

6. Emergency Risk‑Off Mode 🚨

Triggers on market crash, exchange instability, or API anomalies.

Cancels all trades, empties hot wallet to Ledger immediately.

Uses pre‑whitelisted Ledger address for safety.

7. Ledger Hardware Wallet 🔐

Cold storage for profits and unused capital.

Private keys never leave the device.

Can reload hot wallet when scaling up.

🔄 Flow Overview

Scanner → Bot: Finds opportunity.

Bot → Scaling Module:

Decides hot wallet size.

Bot → Exchange API:

Executes trade loop.

Bot → Sweep Logic:

Decides if profits move to Ledger.

Emergency Mode:

Can override everything to protect capital.

Ledger: Final secure destination for funds.

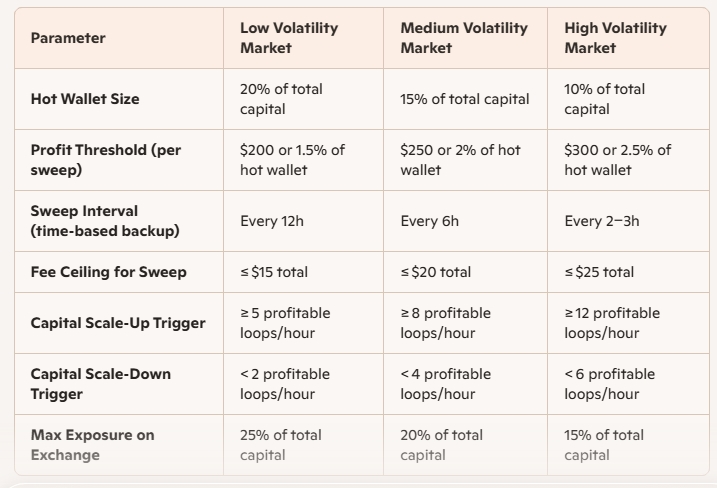

1. Start of Day

Check Exchange Status:

-API health, withdrawal functionality, and liquidity on your main pairs.

Load Hot Wallet:

-Transfer the day’s starting capital based on your Capital Scaling Module (e.g., 10–20% of total capital).

Bot Health Check:

-Ensure opportunity scanner, fee tracker, and volatility monitor are running.

2. Normal Market Conditions

Capital Allocation:

-Low volatility → higher hot wallet allocation (up to 20%).

-Medium volatility → moderate allocation (15%).

Sweep Logic:

-Profit‑based: Sweep when net profit ≥ threshold (e.g., $200).

-Time‑based backup: Sweep every 6–12 hours.

-Fee Awareness: Delay sweeps if network/withdrawal fees exceed your set ceiling.

3. High‑Volatility Conditions

Capital Allocation:

-Reduce hot wallet size (10–15%) to limit exposure.

Sweep Frequency:

-Increase sweeps — every 2–3 hours or when profit ≥ higher threshold (e.g., $300).

Pair Selection:

-Focus on the most liquid pairs to avoid slippage.

Bot Settings:

-Tighten slippage tolerance and shorten loop execution timeouts.

4. Emergency Mode Activation

Triggers:

-Market crash > 5% in 60 seconds on BTC/USDT or your main pair.

-Exchange API latency > 3 seconds or downtime.

-Multiple credible reports of withdrawal delays.

Actions:

-Pause Trading immediately.

-Cancel Open Orders to prevent partial fills.

-Sweep Entire Hot Wallet to pre‑whitelisted Ledger address.

-Confirm on Ledger (or use pre‑authorized emergency sweep if speed is critical).

-Stay in Safe Mode until manual restart.

5. End of Day

Final Sweep:

-Move all remaining hot wallet funds to Ledger.

Review Logs:

-Check for missed opportunities, failed trades, or abnormal fees.

Adjust Thresholds:

-Based on day’s volatility and opportunity frequency.

🧠 Pro Tips for Smooth Operation

Backtest Weekly:

-Use historical data to refine thresholds and scaling rules.

Diversify Exchanges:

-Reduces dependency on a single platform’s uptime.

Automate Alerts:

-Push notifications for sweeps, emergency triggers, and fee spikes.

Ledger Hygiene:

-Keep firmware updated and recovery phrase offline.